Last week Britannia hits 52 week high of 4010 after quarterly result with 117% profit increase on 20 jul 2020 . Now on, 28 July 2020, the issued and subscribed share capital of the company stands increased to Rs. 24,07,25,630/- dividend into 24,07,25,630 after equity shares of face value of Rs 1/- to Varun Berry, managing director upon exercise of 84,000 options granted to him under the Britannia industries (ESOS).

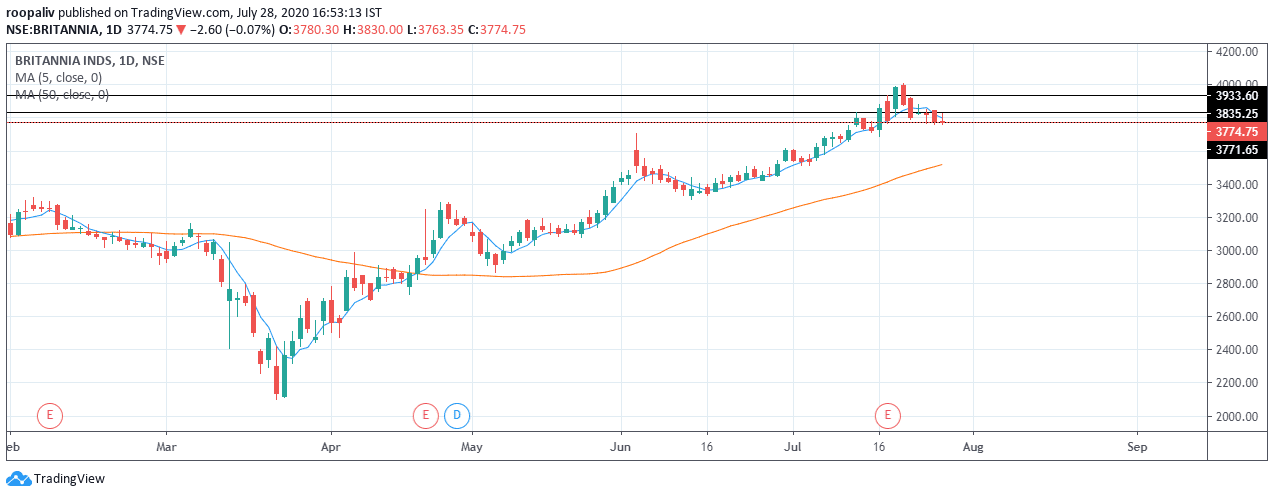

Market discounted ESOS and Britannia stock price fell down on weekly timeframe. It have strong resistance at 3941.43 and support at 3774.75. Overall Britannia is in bullish in trend. If it closes above 3879 then we can see levels of 3940/4000 . If it gives breakdown below 3879 then will test 3730/3720.

One can go long between 3885-3890 with the tgt 3930 sl below 3810.

One can go short between 3777-3780 with the tgt 3750-3720 sl above 3800.

By : ROOPALI VAISH

Note: This blog is only for educational purpose .You should be aware of the risk involved in stock market investing . Mani research is not responsible for any type of loss in financial market. Consult your financial advisor before taking any fresh position