SEBI came up with Investment Advisers Regulation in 2013 that segregated commission selling from investment advice. As per this regulation, no person can work as an investment adviser unless he is registered as an investment adviser with SEBI; and a registered adviser cannot receive remuneration or compensation in any form from any person other than the client being advised. This essentially means that an investment adviser must work on a fee-only model of advisory in India.

This regulation was heavily criticized by the adviser community which was mostly working on commission based advisory model till then. Many people thought that fee-only advisory cannot work in India because investors won’t pay for advice upfront to the adviser. But slowly this model began getting talked about over social media and elsewhere and many investors started seeking advice from fee-only advisers. It turned out that investors are willing to pay a fee for an unbiased advice even in India. Some of the early entrants into this model became successful and that started attracting more and more people to it. Today not only advisers but many DIY investors are thinking of leaving their jobs to become SEBI RIA.

Eligibility for registration as an investment adviser in IndiaFollowing minimum qualifications are required to become an investment adviser in India.

- A professional qualification or postgraduate degree or postgraduate diploma in finance, accountancy, business management, commerce, economics, capital market, banking, insurance or actuarial science.

or You should be a graduate in any discipline with an experience of at least five years in activities relating to advice in financial products or securities or fund or asset or portfolio management. - A certification on financial planning or fund or asset or portfolio management or investment advisory services from (a) NISM or (b) from any other organization or institution including Financial Planning Standards Board India (FPSB) or any recognized stock exchange in India provided that such certification is accredited by NISM.

Documents required

- Proof of Identity

- Proof of address

- Proof of qualification (Degree certificates, NISM exam certificates or CFP certificate)

- Experience Certificate in case of graduates (e.g. Insurance agency license, MF ARN card etc.)

- CIBIL Score

- Net worth certificate from a Chartered Accountant (Minimum net worth requirement is rupees one lakh for individuals or partnership firm.)

- Income Tax Returns for the last 3 years

- Various declarations.

The Applicant for grant of registration as an Investment Adviser under SEBI (Investment Advisers) Regulations, 2013 should make an application to SEBI in Form A as provided in the Regulations along with all the necessary supporting documents.

2. Generally on receipt of Application, the applicant will receive a reply from SEBI within one month. However, the time taken for registration depends on how the applicant fulfills all the registration requirements and provides the complete information in all respects.

3. The applicant is advised to go through the SEBI (Investment Advisers) Regulations, 2013 for checking the eligibility criteria and such other details which may help expedite the registration process.

4. The applicant must mention the following in the covering letter:

a. Whether the applicant is providing investment advisory services prior to these Regulations. If yes, provide details.

b. Details of the investment advice provided prior to such application.

c. It is applying for registration of as a new Investment Adviser providing investment advisory services.

5. As an integral part of the registration process, the applicant will submit the following

a. Form A appropriately filled, numbered, duly signed and stamped.

b. Application fees of Rs. 5,000/- by way of bank draft in favour of “The Securities and Exchange Board of India”, payable at Mumbai.

6. The applicant shall also make an online application in terms of the guidelines as prescribed by SEBI from time to time.

Grant of Certificate of Registration

7. SEBI shall take into account all the requirements as specified in the Regulations for the purpose of considering grant of registration. SEBI on being satisfied that the applicant complies with the requirements approve the application and inform the applicant, on receipt of the payment of registration fees, grant certificate of registration subject to such terms and conditions as the Board may deem fit and appropriate.

8. On receipt of approval from SEBI, the applicant must pay registration fee of Rs.1,00,000/- (If applicant is corporate) and Rs.10,000/- (If applicant is Individual) by way of bank draft in favour of “The Securities and Exchange Board of India”,

payable at Mumbai. On receipt of registration/ re-registration fees, SEBI will grant the applicant the certificate of registration as an IA.

Post- Registration compliance

9. Once registered, the IA must comply with the reporting requirements as specified by SEBI from time to time.

10. The IA must regularly check the SEBI website for any updation/ circulars/ guidelines issued from SEBI from time to time with respect to the IA.

11. The IA must intimate to SEBI any material change in the details already furnished to SEBI within a reasonable period of time.

Please note the following:

12. “The applicant” means the entity seeking registration as an IA

13. Application which is incomplete or without the necessary supporting documents/ information/declarations would not be accepted and would be treated as not filed. However, intimation to this effect will be provided to the applicant within a reasonable period of time.

14. Applications involving policy decisions or other considerations might get delayed in processing and in getting registration approvals.

15. Documents/Annexure submitted along with the application need to be numbered with signature/stamp on each page.

16. In case of an Authorized signatory, please submit an authorization letter from the Directors/Designated Partners of the IA.

17. At present SEBI has its Head Office at Mumbai and 4 Regional Offices i.e. Eastern Regional Office at Kolkata, Northern Regional Office at Delhi, Southern Regional Office at Chennai and Western Regional Office-II at Ahmedabad. SEBI has opened 9 local offices at Bengaluru, Bhubaneshwar, Guwahati, Hyderabad, Indore, Jaipur, Kochi, Lucknow and Patna.

18. Accordingly, the persons seeking registration under IA Regulations may file their registration application with the concerned RO/LO of the Board for grant of registration. The addresses of offices of SEBI are available on the website at www.sebi.gov.in and also on the link http://www.sebi.gov.in/sebiweb/stpages/contact_us.jsp

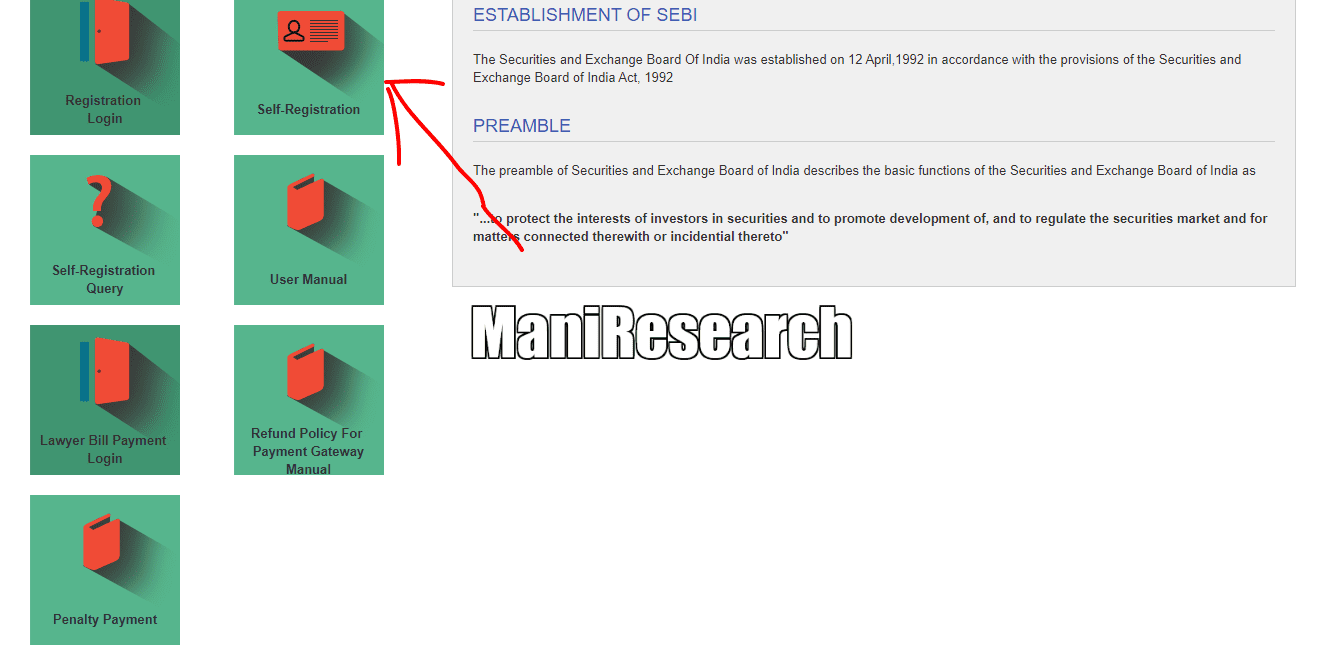

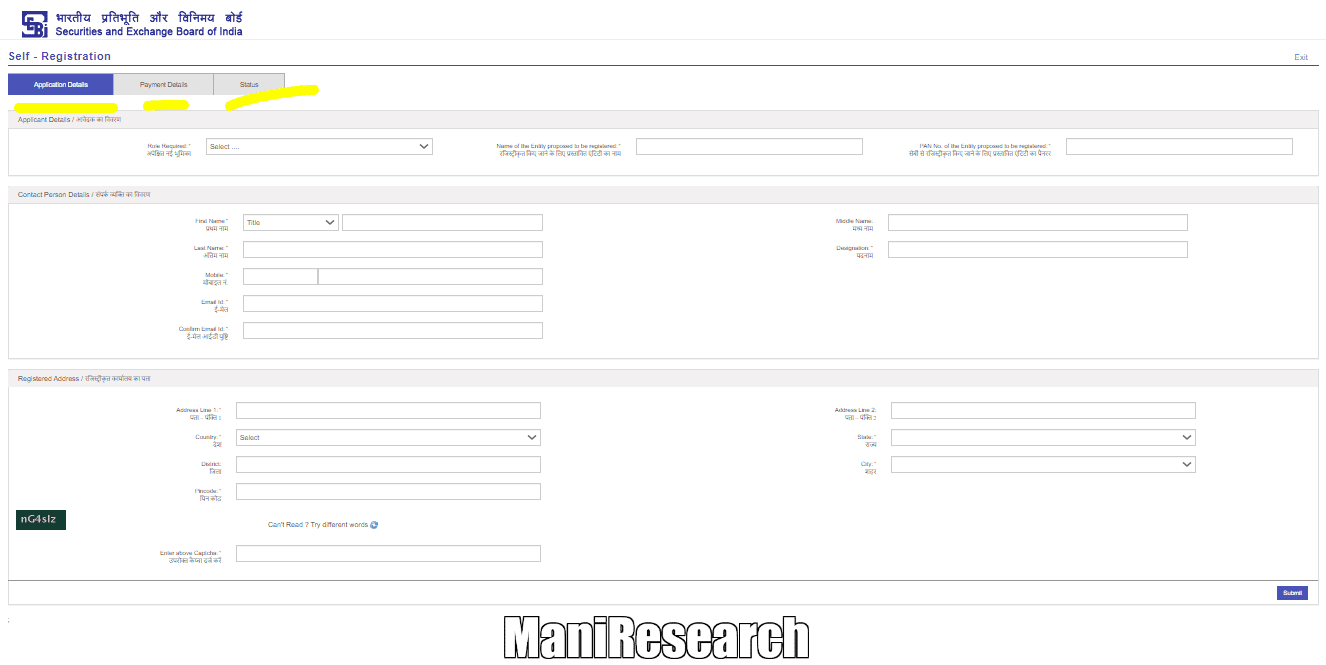

Click on https://siportal.sebi.gov.in/intermediary/index.html and register online with all original and clear documents.