Bet to Buy or Sell, get detail research report

AXIS BANK

As the third largest private sector bank in one of the world’s fastest-growing economies, Axis Bank offers a wide spectrum of financial solutions to a diverse range of customer segments spanning retail, small and medium enterprises, government and corporate businesses.

Overview

· Market Cap: 128,520 Cr.

· Current Price: 455.45

· 52 weeks High / Low 827.75 / 285.00

· Book Value: 240.28

· Stock P/E: 26.85

· Dividend Yield: 0.22 %

· ROCE: 5.70 %

· ROE: 7.66 %

· Sales Growth (3Yrs): 10.61 %

· Face Value: 2.00

Pros:

One of the fastest growing banks

Very good Management

Cons:

Company has low interest coverage ratio.

Promoter holding has decreased by -0.53% over last quarter

Promoter holding is low: 15.69%

Company has a low return on equity of 5.20% for last 3 years.

Contingent liabilities of Rs.810201.83 Cr.

Company might be capitalizing the interest cost

Earnings include an other income of Rs.15915.24 Cr.

Dividend payout has been low at 11.80% of profits over last 3 years

Fundamental Analysis

Axis bank is trading at 26.85 PE multiple which is expensive compared to Bandhan Bank and Indusind Bank however it is cheaper than HDFC BANK, KOTAK MAH BANK and ICICI BANK.

Axis Bank Net Profit grew every quarter except 2019 sep as it write off bad debts and NPA also if we see Revenue then it is increasing every quarter.

Axis Bank also have good CASA number which help the bank to generate excellent revenue.

Return on equity makes this stock as a attractive bet.

Assets of the company are increasing in satisfactory rate which shows that company have good expansion.

Bank Cash flow is negative in investing activity because bank keeps on investing its profit.

ROE% of Axis Bank is above 16% in several years however in 2018 and 2019 it was low so it is very good opportunity for enter for long term portfolio.

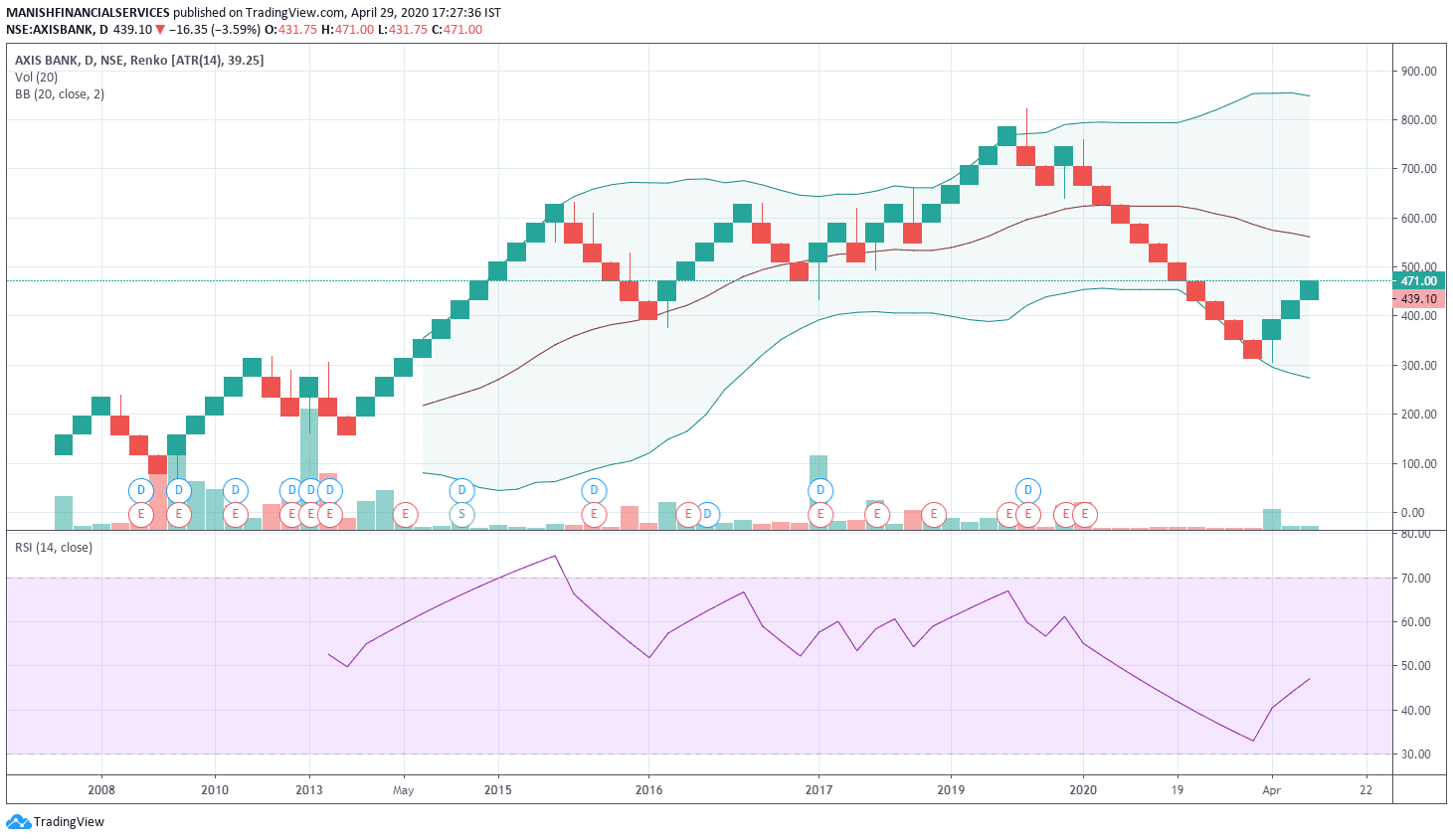

Technicalanalysis

As per Daily Chart Analysis Axis Bank is at good spot for buy however on weekly and Monthly Charts it is still on Sell territory.

Data Analysis:

As per April Contract Open Interest PCR is 0.757 which indicates that Buyers are in control for current contract however breakout still awaits as put writer are increasing to we can see sharp profit booking in May contract.

March 2020 Result update:

Axis Bank Ltd posted a surprise fourth-quarter loss of 13.88 billion rupees ($182.96 million), as it set aside more funds to cover a potential rise in bad loans in a corona virus-hit economy.

The pandemic has dealt a heavy blow to the economy, worsening problems at Indian banks that were already laden with tremendous amounts of bad loans due to their exposure to troubled sectors such as real estate, infrastructure and shadow banking.

Mumbai-based Axis Bank booked provisions of 77.30 billion rupees for the quarter, or nearly three times higher than the year-ago period, including 30 billion rupees towards COVID-19. we expected a profit of more than 15.56 billion rupees.

Separately on Tuesday, Axis Bank said it would buy a 29% stake in insurer Max Life Insurance for about 15.90 billion rupees, giving the lender a seat among rival banks who already have a foothold in the country's life insurance industry.

Axis Bank, which already holds a minority stake in Max Life, will buy shares from the insurer's majority owner Max Financial Services Ltd to raise its stake to 30%, while Max Financial will hold a 70% stake in the joint venture partnership.

Axis shares closed up 6.6% after the deal announcement, in a broader Mumbai market that ended 1.06% higher.

Net interest income grew 19% to 68.08 billion rupees, while net interest margin rose to 3.55% from 3.44% last year.

Gross bad loans as a percentage of total loans, a measure of asset quality, eased to 4.86% at March-end from 5% in the previous quarter.

Recommendation :

Axis Bank Ltd, India's third biggest private-sector lender bank has proven itself in history for its provision and outstanding performance. Currently Govt. Package in line and proactive provision makes this bank good bet for short term trading we recommend following strategy:

Axis Bank Ltd, India's third biggest private-sector lender bank has proven itself in history for its provision and outstanding performance. Currently Govt. Package in line and proactive provision makes this bank good bet for short term trading we recommend following strategy:

1. Buy between 435-440 Target 560 stoploss 429 for very short term trader.

2. Buy above 466 Target 570 stop loss of 429 and trail for every 10 point up move.

3. Buy AXISBANK MAY FUT @ 439 and also BUY AXISBANK 340 PE @5 Rs.

Long Term trader can invest in the form of SIP on monthly basis.

ManiResearch Investment Advisory www.ManiResearch.in +91 8224979882